At the end of the year, it’s important to keep an eye on your health insurance plan. You might be closer than you think to meeting your insurance deductible. Understanding how much you’ve spent out-of-pocket throughout the year on your health can help you plan for potential medical expenses and maximize your insurance coverage. Every medical expense, big or small, from doctor visits to prescriptions, counts toward that yearly limit. Once you’ve reached it, your insurance plan will cover a larger portion of your medical costs. People tend to get busy preparing for the holiday season and planning for the new year ahead and often overlook taking care of their health.

Vascular treatments for peripheral artery disease (PAD) are covered by insurance if they are considered medically necessary. If your doctor determines that the treatment is needed to address a medical condition like chronic venous insufficiency or peripheral artery disease, then most insurance plans will cover it.

If you’ve met your deductible, you may only have a co-pay for your procedure. That means you can say farewell to the numbness and weakness in your legs and hello to healthier, happier legs as you step into the new year. Changes in your toenail growth, or increased leg pain, numbness, or cold feet, might be a sign of potential vascular health issues. Before the year-end deductible resets, take a quick PAD risk assessment test to learn more about your vascular health.

What is a Health Insurance Deductible?

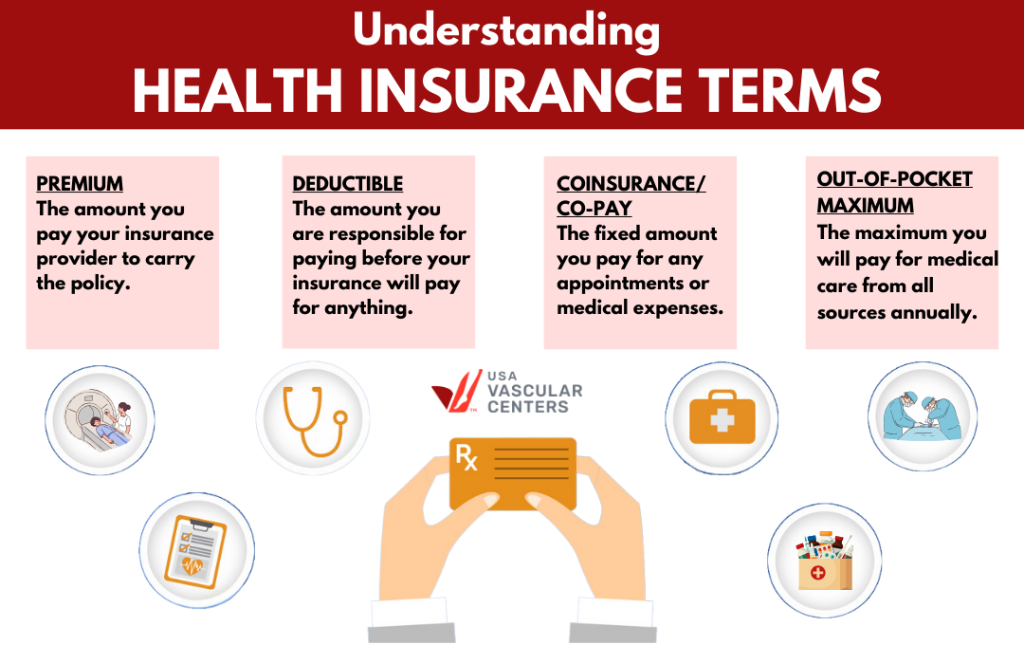

A health insurance deductible is the amount you must pay out-of-pocket for covered health care services before your insurance plan begins to pay. Once you meet your deductible, your insurance company will start covering a portion of your medical costs, typically 80% or more.

Most insurance plans have a deductible that must be met each year. This means starting January 1st, you’ll be responsible for paying out-of-pocket medical expenses until you reach your deductible. To take advantage of your current coverage, it’s advisable to schedule necessary medical appointments and fill required prescriptions in November and December. Some of the reason why it is important to track your deductible include:

- Financial Planning: Knowing how much you’ve spent out-of-pocket can help you budget for future medical expenses.

- Maximizing Coverage: By understanding your deductible, you can make informed decisions about when to seek medical care.

- Tax Benefits: Some medical expenses may be tax-deductible, so tracking your deductible can be beneficial during tax season.

Why Should I Meet My Health Insurance Deductible Before the End of the Year?

After you’ve fulfilled your yearly deductible, your insurance will start covering part of your medical costs. The exact coverage will vary based on your insurance plan. Some plans have a copay system, meaning you pay a set fee for specific services, such as $25 for a vascular center appointment. Other plans use coinsurance, where you pay a percentage of the cost.

How to Prepare for Year-End Deductible:

- Review Your Explanation of Benefits (EOB):

- Check your EOBs for any unpaid balances or claims that haven’t been processed.

- Ensure all claims have been submitted and paid correctly.

- Schedule Necessary Medical Appointments:

- If you have any pending medical appointments or procedures, schedule them before the end of the year to maximize your insurance coverage.

- Consider Preventive Care:

- Take advantage of preventive care services like annual check-ups, screenings, and vaccinations. These services are often covered by insurance plans, even before you meet your deductible.

- Review Your Health Insurance Plan:

- Understand your plan’s coverage limits, deductibles, and co-payments.

- Contact your insurance provider if you have any questions or concerns.

Taking these steps to manage your health insurance deductible can help prepare you for unexpected medical expenses and make the most of your insurance coverage.

What Are Deductible-Eligible Medical Expenses?

Some of the following medical expenses are generally covered by your health insurance depending on the nature of the services and your plan. The costs you incur for these services will reduce your deductible:

- Doctor and therapist visits

- Hospitalizations

- Physical therapy

- Prescriptions

- Surgeries or procedures

- Imaging, scans, MRIs, ultrasound, X-ray, etc.

- Lab tests (blood work, samples, etc)

- Anesthesia

- Medical devices and equipment (pacemakers, blood sugar monitors, wheelchairs)

Your health insurance coverage may vary according to the specific plan you are enrolled in. To understand what your plan covers, check your provider’s explanation of benefits. USA Vascular Centers can also assist you in verifying your insurance and determining your out-of-pocket costs. You can do this by using our online scheduling tool or contacting our customer service team.

The Benefits of Getting Treatment Before the End of the Year

If you’re experiencing symptoms of peripheral artery disease (PAD), such as leg pain, swelling, or numbness, seeking timely treatment can significantly improve blood flow in your legs and overall quality of life. Vascular treatments, designed to address the underlying circulatory issues, can alleviate these symptoms and reduce your risk of serious complications.

The cost of vascular treatments is influenced by two primary factors: health insurance coverage and provider and facility costs.

Health Insurance Coverage:

- Deductible: You’ll likely need to meet your annual deductible before insurance starts covering the costs.

- Co-pay: After meeting the deductible, you might have to pay a fixed co-pay for each visit or procedure.

- Co-insurance: This is a percentage of your cost after the deductible and co-pay.

- Out-of-Pocket Maximum: Once you reach this limit, your insurance typically covers the rest of the costs for the year.

Once you’ve met your deductible, you could pay less out-of-pocket or a smaller co-payment or co-insurance for procedures like angioplasty, stent placement, or atherectomy.

To get a precise estimate of your out-of-pocket costs, talk with your vascular specialist provider and insurance provider. They can provide information based on your health requirements and insurance plan.

Optimize Your Health Insurance Deductible with USA Vascular Centers

If you have already met your insurance deductible, now is the perfect time to prioritize your vascular health. USA Vascular Centers offers minimally invasive treatments for peripheral artery disease (PAD). Our highly-rated doctors and over 168 accredited locations nationwide make it easy to access the expert vascular care you need.

By understanding the potential cost implications and the role of insurance in covering vascular treatments, you can make informed decisions about your healthcare and overall well-being. Schedule an appointment today!